Tokenization is a security technique that replaces sensitive data, like credit card numbers, with unique tokens. These tokens are meaningless to outsiders but still retain references to the original data for authorized systems. It's used to enhance data protection and reduce the risks of data breaches.

The realm of eCommerce websites and platforms is expanding at an unprecedented rate. However, along with this exceptional growth comes an alarming increase in security risks. Instances of fraudulent activities within eCommerce systems are regrettably becoming more commonplace. This pressing issue highlights the paramount importance of implementing effective methods, such as Tokenization, to counteract the escalating threat of payment fraud.

In this blog, we're diving deep into Tokenization – a powerful tool against payment fraud. We'll explain how it works and why it matters for businesses today. You'll learn about the layers of protection it adds, gaining essential insights to safeguard your business in the online world. Join us to master the basics of Tokenization and strengthen your defense against cyber threats.

What is Tokenization?

Tokenization is a security method that transforms sensitive information, like credit card numbers or personal data, into a unique identifier called a "token." This token retains no direct link to the original data, making it useless for hackers even if they manage to intercept it. Tokenization adds a layer of protection by keeping sensitive information hidden, reducing the risk of data breaches and payment fraud. It's widely used in various industries, especially in online transactions and digital payments, to enhance security and ensure customer privacy.

How Does it Work?

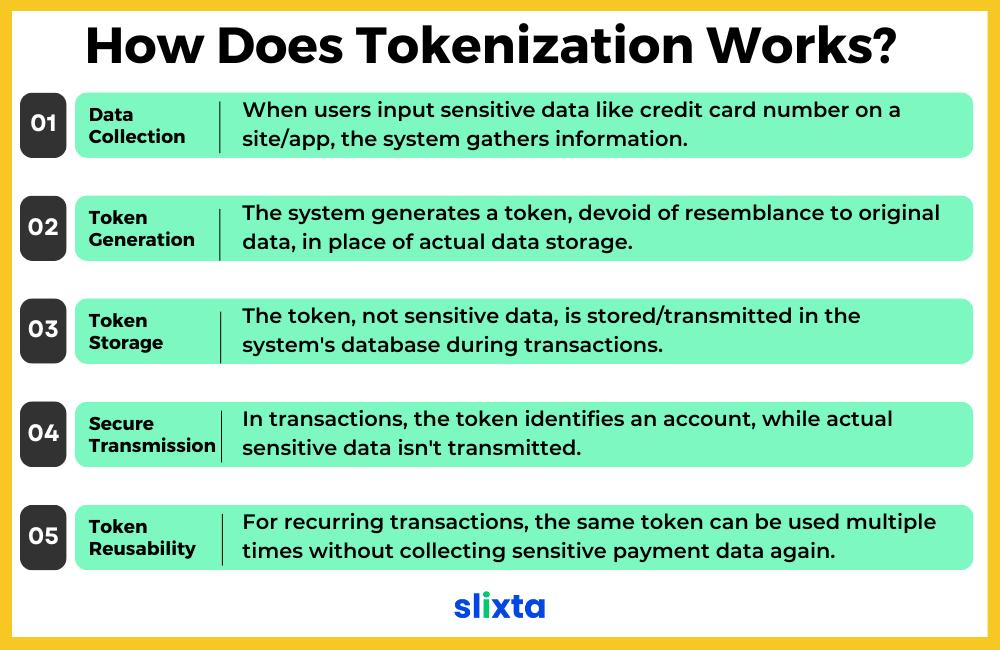

Tokenization works by replacing sensitive data with a randomly generated token, which is a unique string of characters. Here's how the process generally unfolds:

Data Collection

When a user enters sensitive information, such as a credit card number, into a payment form on a website or app, the system collects this data.

Token Generation

Instead of storing the actual data, the system generates a token using encryption algorithms. This token is meaningless and bears no resemblance to the original data.

Token Storage

The token, rather than the sensitive data, is stored in the system's database or transmitted between systems during transactions. Even if a hacker gains access to the token, they won't be able to reverse-engineer it to retrieve the original data.

Secure Transmission

During transactions, the token is used to identify the account or data associated with it, but the actual sensitive information is not transmitted. This adds a layer of security to data exchange.

Token Reusability

For recurring transactions, such as subscriptions or stored customer profiles, the same token can be used multiple times without collecting sensitive payment data again. This simplifies the payment process while maintaining security.

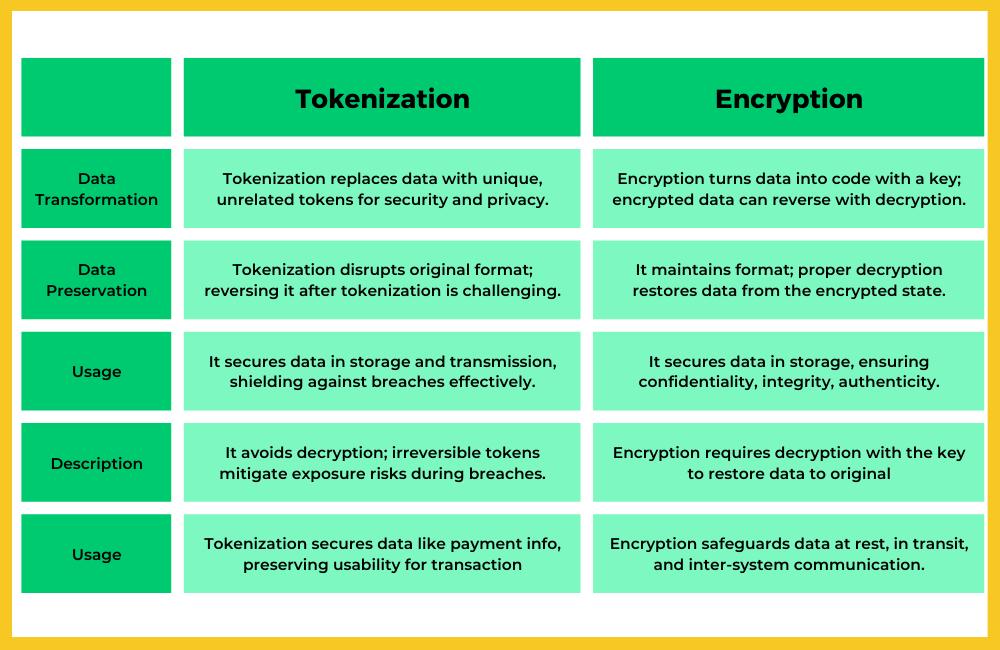

Tokenization vs. Encryption

Tokenization and encryption are both methods used to enhance data security, but they differ in their approaches and purposes. Here's a comparison between the two,

Payment tokenization - Benefits

Payment tokenization offers several significant benefits for businesses, consumers, and the overall security of financial transactions. Here are some key advantages:

Enhanced Security

Payment tokenization greatly reduces the risk of data breaches and fraud. Since tokens have no direct connection to the actual payment data, even if a hacker gains access to tokens, they are useless without the corresponding mapping and decryption keys.

Data Privacy

Tokenization ensures customer privacy by eliminating the need to store sensitive payment information. This reduces the potential impact of a data breach on customer data, enhancing customer trust.

Regulatory Compliance

Many industries are subject to data protection regulations like GDPR, HIPAA, and PCI DSS. Payment tokenization can help businesses comply with these regulations by minimizing the storage and exposure of sensitive data.

Simplified PCI DSS Compliance

The Payment Card Industry Data Security Standard (PCI DSS) requires stringent security measures for handling cardholder data. By tokenizing payment information, businesses can simplify their compliance efforts and reduce the scope of PCI DSS requirements.

Faster Transactions

Tokenization can expedite payment processing by reducing the need to transmit and process actual cardholder data during transactions. This can lead to quicker and more efficient payment experiences for customers.

Flexible Payment Options

Tokenization enables customers to save their payment details securely for future use, providing convenience during repeat purchases or subscription renewals without compromising security.

Global Accessibility

Tokenization can be seamlessly integrated into various payment methods, including credit and debit cards, digital wallets, and mobile payment platforms, ensuring a consistent and secure experience for users worldwide.

Improved Customer Experience

With reduced risks of fraud and data breaches, customers can shop with confidence, knowing that their payment information is well protected. This positive experience can lead to increased customer loyalty and repeat business.

Security for Recurring Payments

Recurring transactions involve storing payment information for future use. With tokenization, sensitive payment data is replaced with tokens, ensuring that even if a breach occurs, the actual card or payment details remain secure.

Conclusion

Tokenization is a powerful shield against the rising tide of payment fraud that threatens the integrity of digital transactions. Tokenization's capability to transform critical information like credit card numbers into indecipherable tokens serves as a bulwark against cyber threats. By thwarting hackers' attempts to trace back to original data, tokenization fortifies the security of payment systems and safeguards against potential data breaches. In a world where online transactions have become the norm, it's imperative for businesses to harness every available tool to ensure the safety of their customers' information. With tokenization, the path to a secure and seamless digital payment ecosystem becomes clearer than ever before.

For more valuable insights and information, check out these related blogs: